Precious Metals

That Stand the Test of Time

Curated Selection

Handpicked precious metals from our most trusted collection. Each item certified for authenticity and quality, chosen to meet every investor's needs and timeline.

0.1g Gold

Essential starting point for precious metals ownership

1g Gold Bar

Perfect foundation for growing your collection

10g Gold Bar

Meaningful accumulation of precious metals

50g Gold Bar

Substantial position for serious investors

100g Gold Bar

Premium holding—significant wealth concentration

1 oz Silver

Accessible entry into silver accumulation

10 oz Silver

Growing position in industrial metal

100 oz Silver

Substantial silver holding—significant potential

500g Silver

Major position for infrastructure ownership

1kg Silver Bar

Institutional-grade holding—pure scale

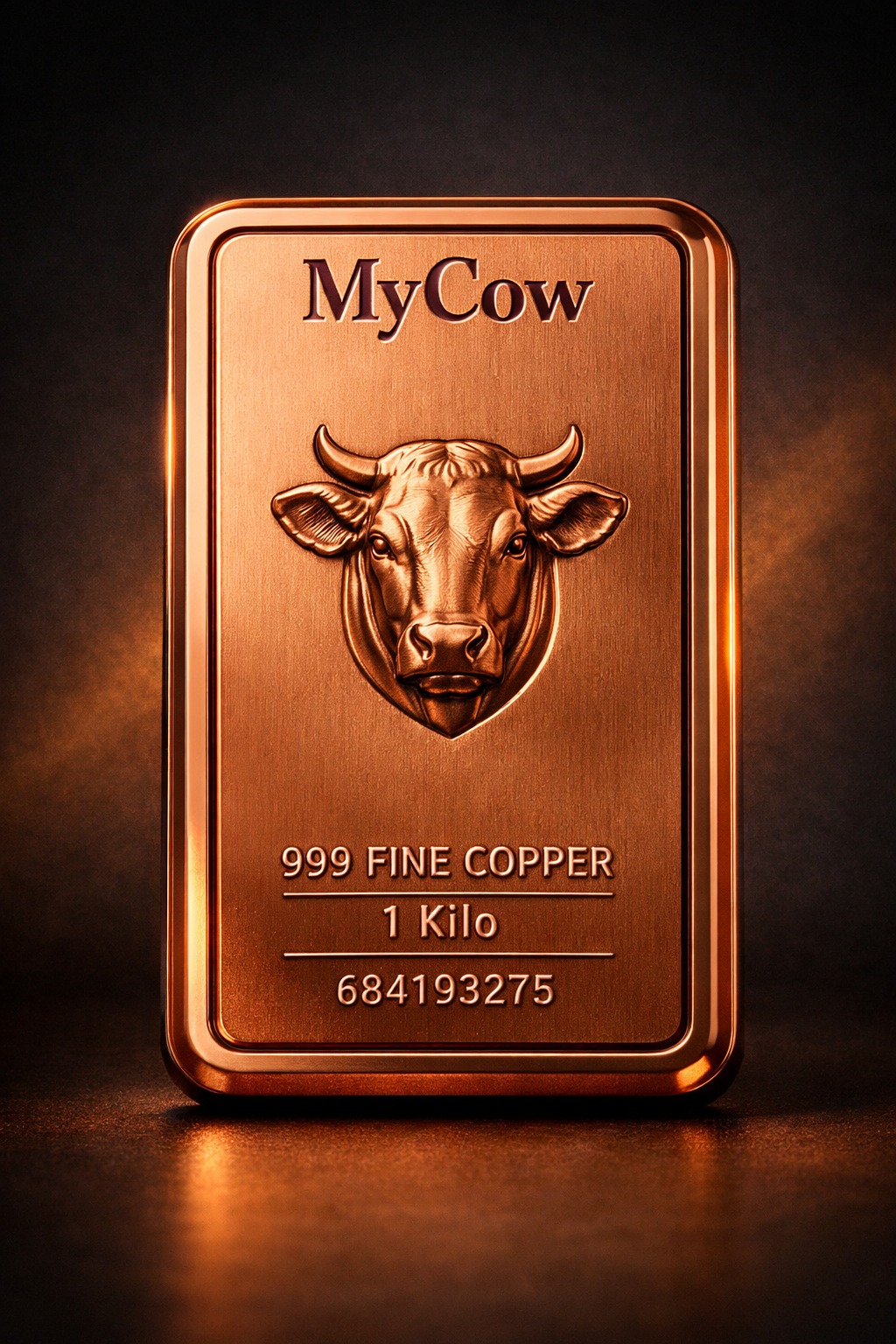

100g Copper

Affordable entry into AI infrastructure

500g Copper

Growing exposure to tech metals

2.5kg Copper

Meaningful position in infrastructure ownership

5kg Copper

Substantial copper holding for serious investors

10kg Copper Bar

Premium position—maximum copper exposure

Market Intelligence

Economic analysis. Supply dynamics. Infrastructure trends. 2025 and beyond.

Silver

Supply Crisis Accelerating

5 consecutive years of supply deficit. Mine production down 10 years. Industrial demand (55%) at all-time highs. Central banks repatriating gold—same institutional sophistication now targeting silver.

Limited supply cannot meet escalating renewable energy demand.

Copper

AI Infrastructure Boom

$500B+ AI data center investment in 2025. Every GPU, every chip, every server runs on copper infrastructure. Same institutions now allocating to metals understand copper is essential for the economy they're building.

Structural supply/demand imbalance benefits investors.

Gold

Dual Purpose Asset

Essential in semiconductors and advanced computing. Also hedging geopolitical uncertainty and economic transformation.

Protects wealth through transformation cycles.

The Institutional Thesis

Central banks aren't speculating. They're diversifying away from currency reserves—a structural shift that institutional investors worldwide understand. When the smartest money in the world (family offices, central banks, sovereign wealth funds) all increase precious metals allocation simultaneously, it's not a trend. It's risk management.

You're not betting against the system. You're positioning like the system does—with optionality across multiple scenarios. This is what institutional-grade portfolio construction looks like. This is available to you now.

Why My Gold Grams Works

Six systems that create trust through verification, not promises.

Certified & Verified

Every metal independently certified by third-party labs. You verify it yourself. No trust required—just facts backed by documentation.

Certification includes origin, purity, weight verification.

Precious Metals as Infrastructure

Silver: 55% industrial demand. 25% of solar supply by 2030. Copper: Every AI data center. 15% demand surge from AI alone. Gold: Advanced semiconductors. Computing backbone.

These aren't speculative assets. They're essential to the infrastructure being built right now.

Live Market Pricing

Track COMEX and CME futures in real-time. See exact spot prices. Zero hidden markup. Our margin: 2-4%. Industry standard: 5-15%. You see the math.

On a $10,000 investment, you save $1,000-1,100 compared to legacy dealers.

Secure & Insured

Fully insured delivery within 24 hours. If anything goes wrong, we replace it immediately. Market-rate buyback guaranteed. No negotiation.

Your protection is backed by systems, not promises.

Educational First

Free webinars on supply dynamics. Free guides on market fundamentals. Free analysis of infrastructure trends. Why? Because educated investors make better decisions—and better decisions create long-term customer relationships.

We give away our best content because we believe in abundance.

Digital Native = Fair Pricing

No retail overhead. No inventory carrying costs. No sales commission pressure. Pure digital means direct access to fair pricing. Every efficiency we gain passes directly to you.

Being a startup isn't a limitation. It's our structural advantage.

Ready?

Own infrastructure that powers the future. Or take time to educate yourself fully. There's no pressure—the trend is just beginning.

Blind Side Protection for Founders

You can see your business threats coming. But what about the risks you can't see? Our framework helps you identify, quantify, and protect against macro blind sides.

Blind Side Risk Score

Take our 5-question assessment to understand your exposure to macro risks—currency, geopolitical, concentration. Get your personalized allocation recommendation.

Pre-Built Bundles

Bronze (5%), Silver (10%), Gold (15%)—left tackle formations sized for your risk profile. One-click purchasing. No decision fatigue.

Founder Community

Connect with other builders. Weekly market intel. Expert panels. Resource library. Exclusive deals. Build wealth without isolation.

Real Founder Story

How Alex went from 90% concentrated to protected. From blind side exposed to strategically hedged. Real results. Real framework.

Start with your blind side assessment, then build your left tackle formation.

Calculate Your Risk Score→Questions Before You Invest?

We address the most common concerns so you can invest with confidence.

How Do I Know It's Authentic?

Every metal independently certified. You verify it yourself. No "trust us"—verification is built in. Transparent sourcing documented.

See CertificationsIs This the Right Price?

Live COMEX pricing. No mystery markup. No intermediaries inflating cost. Compare in real-time. Fair price, always.

Live Price ToolI'm New to Precious Metals

We won't sell you what you don't understand. Webinars, guides, market insights—education is foundational to how we operate.

Free EducationIs My Investment Protected?

Fully insured delivery. Market-rate buyback guarantee. Third-party certification is independent of our company. Your metal is secure.

Protection DetailsIs the Process Simple?

Digital-first design. No phone calls. No pressure. Shop whenever. Transparent checkout. Real-time tracking. Your metals work as silent protection—your blind side hedge, uncorrelated to everything else in your portfolio.

Try CheckoutWhy Precious Metals & Digital?

Metals power AI infrastructure and renewable energy. We're pure digital—no retail overhead means fair pricing. Direct to you.

Learn WhyStill have questions?

View Full FAQInvest with Confidence

Our guarantees and commitments ensure your peace of mind at every step.

Authentication Guarantee

Every precious metal is certified authentic by industry-standard third parties. If authenticity is ever questioned, we replace it at no cost.

Secure Delivery Promise

Fully insured shipping with tracking. If your package is damaged or lost, we replace it immediately. Zero hassle.

Transparent Pricing

No hidden fees. Price based on live commodity markets (COMEX, CME). What you see is what you pay. Always.

Expert Support

24/7 access to precious metals experts. Questions about products, markets, or investing? We're here to help.

Market-Rate Buyback

Want to sell? We buy back at current market rates. No negotiations. Fair price guaranteed based on weight, purity, and spot price.

Educational Resources

Free webinars, market analysis, and investing guides. Learn precious metals fundamentals before you invest.

Our Commitment to You

We're not just selling bullion. We're building relationships with investors who trust us to protect their wealth. That's why we go beyond industry standards—we guarantee authenticity, transparency, and fair pricing on every transaction. Your confidence is our foundation.

Have more questions? We've got answers.

View Frequently Asked QuestionsUnderstanding Markets

Understand supply dynamics, market trends, and the infrastructure role of precious metals.

Central Banks, De-Dollarization & Your Blind Side

Why 1,086 Tonnes in 2024 Matters

Central banks purchased more gold in 2024 than in the last 30 years combined. This isn't speculation—it's institutional risk management. Understand the geopolitical forces reshaping currency reserves and what that means for your portfolio.

Infrastructure Metals: Silver, Copper & AI

The Metals Powering the Next Economy

Silver for solar (25% by 2030). Copper for AI infrastructure (15% demand increase). Gold for semiconductors. These aren't speculative plays—they're essential to the infrastructure being built right now. See the numbers behind the demand.

The Left Tackle Strategy: Portfolio Protection for Founders

Your Blind Side Hedge Explained

You're the quarterback. Your business is the play. But what protects you from what you can't see? Learn how successful founders structure metals allocation as their "left tackle"—silent protection that runs itself while you focus on growth.

The Allocation Framework: Exactly How Much You Should Own

Institution-Grade Strategy for Individual Investors

How do family offices, sovereign wealth funds, and central banks size precious metals allocation? Learn the framework, apply it to your net worth, and get your exact allocation number based on your portfolio size and risk tolerance.